Tax proposals for large fortunes in Europe and South America: infographics

Wealth tax: Proposals in Europe and South America and debate on proposals in Argentina in the context of the COVID-19 pandemic

Researchers: Julia Strada, Hernán Letcher, Magdalena Rua and Lucio Garriga Olmo [1]. Translator: Valentina Castro. April 30, 2020. Download PDF version in here.

The sanitary isolation measures provided by the National Executive and accompanied by different levels of the State and the private world, mean a strong decline in national economic activity. The same is true in each of the economies of the rest of the world, which increases negatively impacts Argentina under the recession of major trading partners, such as Brazil and China. Argentina’s economic context in the previous COVID-19 stage was already complexand with the isolation measures provided by the pandemic this local situation is aggravated. The country is in unsustainable debt (these terms have been defined by the FMI), which reached 89% of Argentina’s Gross Domestic Product as of December 2019.Argentina’s economy shows a worrying advancement of poverty, even before the impacts of quarantine, the last data results, collected as of December 2019, show that 35.5% of Argentina’s population is considered poor, as well as an alarming level of poverty, which reached 8% in December 2019.In addition, in recent years there has been a decline in the level of purchasing power of wages by 15 points, that was not reversed until the start of the pandemic.

The national state ordered a series of measures aimed at sustaining family income and subsidizing companies –at the same time as granting them liquidity – for almost 3% of GDP, but it is still important to assess for how long the quarantine or measures to protect the population are extended to analyze whether the magnitude of fiscal and credit expenditures is sufficient. Until now, the measures taken by the Argentine Government consisted of:

– Provisions to sustain activities through teleworking and licenses.

– Employment support policies by business financing.

– Income policy for vulnerable people (emergency family income, retirement bonds and social benefits).

– Price controls (maximum price policy).

– Financing policies for the real economy (guaranteed credit program for SMEs -FOGAR-, zero-rate loans for freelancers and self-employed).

How are these decisions financed? This question has generated various debates in recent weeks, where proposals have been made to reduce wages to political positions executive and legislative, renegotiation of debt interests as a replacement for these expenses, the monetary issue itself from the BCRA financing the Treasury, or the tax on large fortunes.

In this framework, the report has two parts: in the first part it offers a survey of the proposals (or in some cases they have only become initiatives) that they gave in other parts of the world regarding state financing associated with wealth taxes, and in a second part, an exercise is carried out to estimate the additional collection that would provide the establishment of a similar tax in Argentina with extraordinary character.

COVID-19 and Wealth Tax: Proposals in other countries

On April 3, the Financial Times editorial recognized the need for governments to carry out radical reforms and take an active role in the economy. It warned that redistribution will be back on the political program and taxes on income and wealth will have to be present. This editorial generated debate, considering that it was the main British financial newspaper. It is difficult to determine how deep and intense it can be in modifying the visions on the way out of the pandemic crisis. To what extent will states be the ones that will be structurally strengthened, or will it only be a temporary situation?

The truth is that this crisis has opened debates around the world, specifically in relation to the need to advance in greater tax justice. It should even be noted that it has been the International Monetary Fund (IMF) itself that recommended the adoption of fiscal measures that involve the increase of the aliquots for the highest sections of income tax and personal property. On April 6, the IMF published a report prepared by the Department of Fiscal Affairs, which is part of a special series of suggestions on fiscal policies to respond to the coronavirus emergency. It is interesting to note that it is recommended, among other things, to secure income and promote solidarity. This suggests considering increasing the higher rates of income tax, personal property tax or wealth, which could be achieved through a «solidarity surcharge».

Additionally, it suggests closely monitoring large taxpayers who may comply with the filing and payment of their obligations, recognizing that filing and payment compliance problems may be greater for smaller companies.

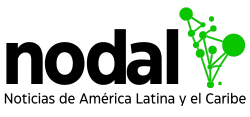

Based on this general framework that shows a crisis -at least conjectural- of the premises supported by liberalism, a series of cases collected in the media (and eventually verified with primary sources in the countries) are detailed in the table below where the proposal for a new tax on assets in this pandemic context has been publicly manifested.

Spain

In Spain, the political force Unidas Podemos, a member of the government coalition together with the Spanish Socialist Workers Party (PSOE), has expressed the intention of creating a «temporary solidarity tax» on large incomes or large statesto pay for sanitary measures and the economic consequences caused by the pandemic[2].

The force led by Pablo Iglesias, Second Vice President of Spain, has not released important details of his proposal as a result of the opposing positions within the same government due to the refusal of important sectors of the PSOE (and before a specific consultation, they stated that the project still is in preparation). Taking this into account, the tax planned by UP at this time -according to the Spanish press- would not have the permanent character of the tax on large fortunes contemplated in its electoral program.[3]

There is also debate in Spain on a reform of the Personal Income Tax (IRPF) to increase by two points the rates for taxpayers with incomes above 130,000 euros and four points for those that exceed 300,000 euros. In addition, an increase in Corporation Tax is evaluated for large corporations.[4]

On the other hand, Más País, the political force that integrates Íñigo Errejón, former ally of Pablo Iglesias and cofounder of Podemos, proposed a series of economic and social measures to face the crisis. Among them is the creation of a «civic solidarity tax for those who have the most.» According to the proposal: «We must create a Solidarity Tax Civic to the great fortunes, to impel a tax Tobin (on the International Financial Transactions) for the financial movements and to start up a tax to the big technological companies (Google, Facebook, Amazon, Netflix…) whose income is being less affected”.The tax on great wealth would impose an aliquot of between 1% and 1.7% on assets over one million euros and 2% for those over two million. In addition, Más País party proposes to modify the Personal Income Tax (PIT) for those people who receive wages above 100,000 euros per year. In this way, the tax would go from the current 45% to 47% for those who earn more than 100,000 euros and from 56% to 60% for those who earn more than 600,000 euros. At the same time, Más País proposes to abolish tax benefits for large companies that do not have a social or environmental purpose and to implement the Tax on Certain Digital Services by increasing it to 5% (the government’s first intention is 3%). This would affect online advertising services and data sales and would only affect companies with a turnover of more than 750 million euros in the world and three million in Spain.

Italy

In Italy, the establishment of a progressive “Covid tax” (Codiv tax) is being studied to be establish during the years 2020 and 2021. The proposal is to create an amendment to the decree “Cura Italia”, an economic aid plan launched by the National State a few weeks ago. The proposal, made by two Deputies of the Democratic Party -force that integrates the government- Graziano Del Rio and Fabio Melilli, is to apply a tax of 4% to those annual revenues that are between 80 thousand and 100 thousand euros; 5% between 100,000 and 300,000; 6% between 300 thousand and 500 thousand euros; and 8% above half a million euros.

According to the deputies, this tax will be in force in 2020 and 2021 and would affect a total of 803,000 taxpayers -with the exclusion of doctors-, which represents 1.95% of the total 41.2 million. In this way, they aspire to raise 1,300 million euros for «all those who are in a situation of poverty due to the crisis» and for families «who do not have sufficient resources, not even to purchase essential goods».

Despite this, some important PD leaders and members of other government forces, such as the 5 Star Movement, have rejected the proposal and promised to stop it in the national Parliament.

UK

The member of the Labour Party, and until a few weeks ago the Shadow Cancellor, a position held by the opposition to control and discuss government policies -, John McDonnell proposed, before leaving office, that the United Kingdom impose a wealth tax on the richest sectors of the country and, in addition, a tax on the banking industry to circumvent and pay for the measures that have had to be carried out by the pandemic.

For Labor, the country could pay the necessary measures through «an immediate tax on extraordinary profits in banks and the financial sector that we rescued when they caused the crisis a decade ago.» The current Shadow Cancellor is Annaliese Dodds since last April 5, the first woman to occupy the position, and she is the spokesperson for financial issues of Labor. She maintained on April 15 that a «new social tax contract» is needed and detailed: «The richest 10 percent are paying less, proportionally, than the poorest 10%” (quoting the Office of National Statistics). «That was not sustainable at the time when we were not in this crisis and especially it is not sustainable now.» It is not yet clear if his sector will advance with a concrete proposal on the table, but the public debate exists.

The idea is no stranger to more conservative circles in the UK. In an article dated April 17 this year, Tim Pitt (former senior Treasury adviser to two former Conservative finance ministers, Sajid Javid and Philip Hammond and now a partner at Flint Global) argued: «The high levels of inequality affected were already Undermining faith in our system and holding back social mobility, and IFS analysis can affect the lower incomes that suffer the greatest losses from this crisis. Those at the top of the distribution must do the heavy lifting when it comes to paying for her «.

Switzerland

In Switzerland, the proposal comes from the Swiss Labor Party – Partido Obrero y Popular (PST-POP), which is not part of the government and has little social representation. He proposed to apply a single, direct tax of 2% on all fortunes above 3 million francs with the aim of contributing to the self-employed, the unemployed and small businesses. The proposal is called the «Coronavirus solidarity tax» and would raise 17.5 billion francs. The party points out that «the amount would be destined to concrete and solidary support and, therefore, would not have to be reimbursed, unlike loans and credits.»

Curiously, the party was based on a study by Credit Suisse, which determined that last year 400,000 millionaires in the country had a wealth of 702,000 million francs. “These millionaires must now contribute to the common good and to the recovery of the economy. And not only with words, but with a specific contribution” says the party.

Russia

The government of Vladimir Putin takes advantage of the context of the pandemic to promote taxes that it had on file, mainly aimed at more affluent sectors. According to media reports, many of Russia’s wealthiest people own their national businesses through entities registered in low-tax offshore jurisdictions such as Cyprus and the British Virgin Islands. In this regard, Putin announced that he will apply a 15% tax on dividends in foreign accounts and a 13% tax on bank deposits of more than one million rubles. [5].

The Russian government assured that these changes will take effect from January 1, 2021 and, therefore, will not extend to the income paid in 2020. In addition, the deposit tax will only be applied to interest. that they produce and not on the amount of the deposit itself. Therefore, the tax on interest on bank deposits for the year 2021 would only be withheld only in 2022, as stated by First Deputy Prime Minister Anton Siluánov.

According to Putin, the proceeds from these measures will be used «to support families with children, people who have lost their jobs or are sick.» According to the president himself, the measure to tax the interest on the deposits of these fortunes would only affect 1% of national holders.

Germany

The case of Germany was not listed in the previous table, since the establishment of a wealth tax is not being discussed in this context of a pandemic, but the truth is that this country provides one of the most interesting antecedents to recover in the framework of this global and local debate. The so-called complementary solidarity tax (“Solidaritätszuschlag”) or Soli that is taxed in Germany is one of the clearest antecedents: it is aimed at serving those who have the least with a contribution from those who are in better relative conditions.

After the fall of the Berlin Wall, the Soli was created in 1991 but it was important since 1995 for the German reunification to allow a uniform development. Basically it consists in a surcharge to Income Tax (which in Argentina would be the Income Tax of the 4 categories) and implies an additional 5.5% on the current rate of said tax, but only for those with higher incomes. The tax levies incomes of dependent workers, retirees, and also incomes from companies and one-person firms, also capital income and.

This additional collection allowed, in Germany, to reactivate the economy, instead of appeasing investment as is usually argued by some liberal sectors as a critical argument for taxation.

The tax, which has been in place for 30 years, has hitherto had a relatively low limit. In the category related to workers, the additional solidarity tax is taxed from 972 euros, but the rate of 5.5% applies only above 1,340 euros. Germany’s recent decision was not to eliminate the tax, but to keep it only for one segment, the one with the highest income. From 2021 the tax exemption will be significantly increased so that 90% stop paying it: for an individual person, it will go from 972 euros to 16,956 euros, and if it is a couple, the joint income goes from 1,944 euros to 33,912 euros. It would remain with similar characteristics for the highest income: around 3.5% of taxpayers must continue to pay the full amount.

It should also be mentioned that the soli tax reaches financial income: it includes interest, dividends and profits from the sale of shares and funds, from banks and mutual funds of investment.On the other hand, Germany has not had a wealth tax for 20 years but taxes inheritance (it is estimated that 80% of assets are by inheritance)[6]. However, last year the German Social Democratic Party (SDP) proposed to reintroduce the wealth tax for fortunes of more than 2 million euros, a topic that was raised in the German public debate these days and as a result of the impact of the coronavirus. However, Merkel’s party (CDU) rejected it and said that now is not the time to approve it.

Denmark, France, Poland and Austria: exclusion of tax benefits to offshore companies

In Denmark there are currently no proposals to create a tax on great wealth, but the government’s decision is to exclude companies based in tax havens from state aid. Denmark’s Finance Minister Nicolai Wammen confirmed that companies in the country based in tax havens will not be able to receive state financial aid to deal with the pandemic crisis.In this way, the government assured that they will be left out of the 100 billion kroner (£ 11.72 billion) financial rescue program launched to try to mitigate the impact of the Coronavirus pandemic.»Companies seeking compensation after the extension of the schemes must pay the tax for which they are responsible under international agreements and national regulations,» they said from the economics ministry through a statement.[7]

In France the proposal is similar. French Finance Minister Bruno Le Maire announced on April 15 that he will prevent companies registered in tax havens from accessing the state rescue fund. «If a company has its tax headquarters or subsidiaries in a tax haven, it will not be able to benefit from state financial aid,» he told France Info radio.On the other hand, in Poland,[8]On 8 April, Prime Minister Mateusz Morawiecki said that large companies that wanted to benefit from the approximately $6 billion rescue fund had to pay taxes. «Let’s put an end to tax havens, which are the bane of modern economies,» he said.

In Austria, deputies from the “Austrian People’s Party” and “The Greens”, who are part of the government coalition, asked the Austrian Parliament for the government to draft a law that blocks companies located in tax havens from benefiting from approved state aid to compensate losses caused by the coronavirus. This would be an exclusion for «companies whose headquarters or that of their parent company is in a State on the European Union list of non-cooperative countries and territories for tax purposes», such as the Cayman Islands, Panama, the Seychelles or the Virgin islands.[9]

European Union

The economists Gabriel Zucman and Emmanuel Saez (University of California at Berkeley) and Camille Landais (London School of Economics) proposed in an article published on the English portal Voxeu the creation of a European, temporary and progressive tax throughout the EU on 1 Richest% of all population in the block. In this way, the threshold would be from two million euros. According to the authors, the proceeds will be dedicated to the reimbursement of Eurobonds issued by the multilateral organization during the crisis caused by Covid-19 or to the financing of a common rescue fund. The proposal focuses on the 1% most concentrated of the European economy, since that sector of society owns around 20% and 25% of the total wealth in the Scandinavian countries, France, Germany and Spain. A wealth tax is proposed for only 1% of wealthier Europeans, which would generate a large amount of tax revenue while preserving the wealth of the bottom 99%. «The richest 1% of European adults own about 22.5% of total wealth, and the top 0.1% about 10%», the study states.

This proposal is based on the imposition of a progressive tax on three scales: wealth between two million and eight million euros would pay 1% per year; the riches that exceeding eight million euros would pay 2%; and wealth of more than a billion euros (330 people) would pay 3% annually. In this way, 99% of European households would be exempt from paying[10].

In this way, 1.05% of the EU’s GDP per year would be collected, which would allow, in a decade, to pay and sustain the rescue funds calculated at 10 points of GDP as a result of the emission of Eurobonds or from creating a common fund. «It would change the discussion on how to pay the costs of the crisis from a question of international transfers (through European countries) and, instead, focus the discussion on transfers between individuals according to their means (regardless of their nationality)», the authors assure.

The authors also propose a tax on the entire block for different reasons. One of them is that by being a community it will be possible to avoid the evasion and flight of capital to tax havens within the group itself. Likewise, it could be made effective through cross-border cooperation mechanisms between banks and tax administrations and would symbolize the feeling of solidarity within Europe after leaving the United Kingdom and at a time when nationalisms are growing.

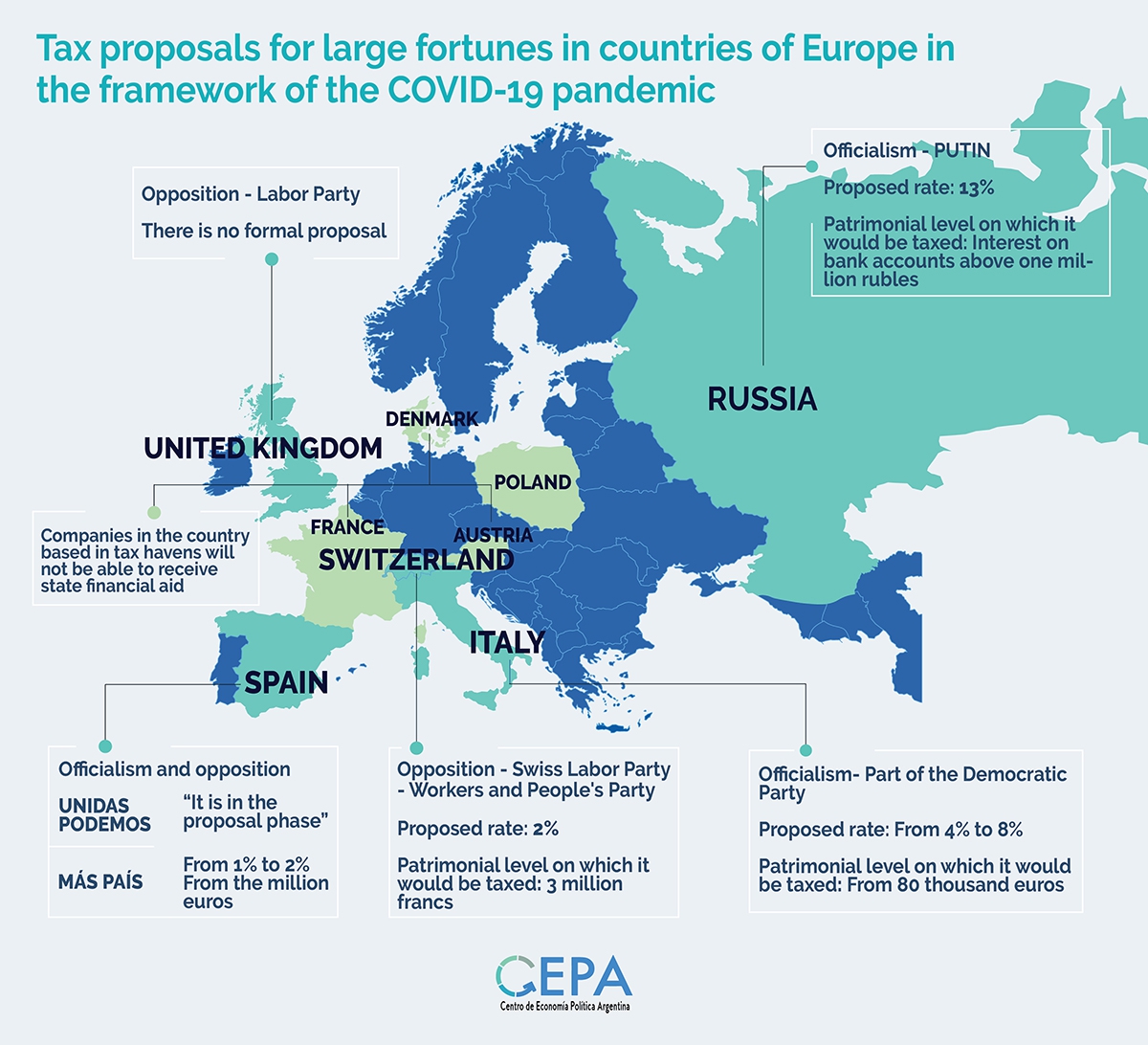

Brazil

The Brazilian Constitution provides for the Tax on Large Fortunes (IGF), but it needs a law that was never approved. For this reason, the National Deputy for the Workers Party (PT), Paulo Guedes, presented a Proposed Amendment to the Constitution (PEC)[11] to allow the immediate imposition of the tax. In this way, while the national Congress treats and approves the project, the national State and the provincial states may begin to apply a 2.5% tax on the value of assets that exceed R $ 50 million. Furthermore, the Guedes amendment proposes that the proceeds be used for the construction of houses and sanitary units. It also establishes that the taxpayer who voluntarily presents himself for the payment of the tax will receive a reduction of the rate from 2.5% to 1.5% and that he will be able to choose where to invest the resources among the different projects approved in advance. Along these same lines, and in relation to the COVID-19 pandemic, the Federal Deputy of the Workers Party (PT) for the state of Rio Grande do Sul, Henrique Fontana, asked “to collect fair taxes to establish a national fund for emergency to face this serious crisis from the point of view of health and that will have serious repercussions on the economy in the next period” and that this “means immediately introducing measures such as the tax on large fortunes”.

There are, in addition, three other projects presented in the Senate to tax large fortunes.[12]

Two of them were presented some time ago and were never treated, while the rest were presented in the context generated by the Coronavirus crisis.

One was in charge of the independent Federal Senator Eliziane Gama for the state of Maranhão. Her project provides for the imposition of assets on income that is over 12 thousand times the income tax exemption limit. Another of the projects was presented by the Senator of Podemos of the Federal District, José Antonio Reguffe. It would impose a 0.5% tax on net assets above the value of 50,000 minimum wages and would only be valid during the pandemic. Another of the proposals (PL 183/2019), corresponds to Senator Plinio Valerio (from the PSDB-AM party) and was presented last year, but has not yet received an opinion from the committee. The project —before the pandemic— deals only with the Tax on Great Fortunes and is considered Great Fortune to shareholders’ equity that exceeds 12 thousand times the monthly limit of exemption from income tax (R $ 1,903.98). Rates would range from 0.5% to 1%.

In addition, in this national and international context some centers and groups such as the National Federation of State and District Tax Authorities (FENAFISCO), the Fiscal Auditors for Democracy (AFD), the National Association of Fiscal Auditors of Federal Revenue of Brazil (ANFIP) and the Tax Justice Institute (IJF) presented tax proposals through an open letter in order to obtain resources to finance the urgent and necessary measures to face the detrimental effects of the pandemic. In its eighth point, it proposes the institution of the Tax on Great Fortunes (IGF) with a progressive rate of 1%, 2% and 3% on assets that exceed 20 million Reales, 50 million Reales and the 100 million Reales, respectively. According to the authors, with a conservative estimate, applying this tax would affect 0.09% of taxpayers and could generate R $ 40 billion per year. They also propose that profits and dividends remitted abroad be subject to exclusive taxes of a rate of 25%, and that it should be 50% in case the destination is a tax haven. This measure would be able to raise R $ 28 billion.

Peru

In the Andean country there are also similar proposals. The left-wing New Peru force, led by Veronika Mendoza (former legislator 2011-2016), released various economic proposals to alleviate the crisis by COVID-19, including creating a 1% tax on millionaire companies in the country.

The leader assured that in Peru «there are six great entrepreneurs who are in the international ranking of the richest in the world» and exemplified in the figure of Carlos Rodríguez Pastor, of the Interbank group, who has a fortune of 4 billion dollars

(«The Lord is not going to be poor, but in this case the Peruvian State will allow him to raise 40 million soles,» said the leader Mendoza.)[13].

For its part, the Popular Agricultural Front of Peru (Frepap)[14],they presented a bill for individuals and legal entities that bill more than one million soles per year to pay a solidarity tax. It establishes three categories: a rate between 0.22% and 1% for fortunes of one million soles per year; a tax between 1% and 2% for those who invoice 10 million per year; and another between 2% and 3% for those who exceed 50 million soles. In the last elections, the Popular Agricultural Front of Peru (Frepap), surprised as the third majority bench with 16 deputies.In addition, the bill states: «The destiny of the tax created by this law, under criminal responsibility, must serve for the inclusion of Peruvians at all levels in which the Peruvian State is absent, call education, health and creating productive work.«[15]

Bolivia

In recent days, the former Minister of Economy and candidate for President of the Movement for Socialism (MAS), Luis Arce Catacora, spread a political program called “Primero la Vida” where he proposes to create “a Solidarity Fund for Health” by applying a tax to great fortunes. This measure is still in the assembly and polishing phase, since the sources of the party’s national leadership stated, consulted for this study, that it is not finalized.

Chile

In Chile there is no formalized proposal, but from the Communist Party, where Camila Vallejo has institutional representation as a deputy, the initiative was expressed in the public debate. In a consultation made for this report, Vallejo’s chief of staff approached us with a document prepared by the economist Fernando Carmona, from that space.

The foundation of the proposal maintains that according to the Central Bank of Chile («Distribution of non-pension wealth of households», 2017) 72% of the country’s wealth is concentrated in the richest 20%, on the other hand 20 Poorer% has null or negative levels of wealth, with a Gini result between families of 0.73. In addition, according to the Boston Consulting Group report, private wealth in Chile reached US $ 393 billion in the year 2016, that is141% of the Chilean GDP that year. If we assume that the proportion has been maintained and not increased – which is more likely-, then in 2019 private wealth reached US $ 427 billion. In turn, according to estimates, the Ramon Lopez study cited by the Carmona document, 1% concentrates 30.5% of wealth in Chile, that is, $ 130,235 million. Of this wealth, the 10 richest people in the country have $ 37.3 billion, that is, a 2% tax on the wealth of these 10 people would leave a collection of $ 746 million annually, increasing the tax revenue to 0.3% of the Chilean GDP.

The document also mentions the survey of the richest assets, returning to the Forbes list, where Iris Fontoba ranks first, number 74 among the richest in the world, $ 15.4 billion (Luksic Group); then Julio Ponce Lerou, place 422 among the richest in the world, with $ 3.8 billion; Horst Paulman, ranked 745, with $ 3 billion; Alvaro Saieh, ranked 745, with 3,000 million; Sebastian Piñera, ranked 804, with $ 2.8 billion, among others.

The proposal made by the economist of the Communist Party, Fernando Carmona would consist of:

- Create a wealth tax directed at the richest 1% of the country.

- With an annual rate of 2%.

- That it be charged until the distribution of wealth among families, measured by the GINI reaches 0.25.

- Collection estimated at 1.04% of GDP.

Ecuador

The congressmen close to former President Rafael Correa have presented a package of measures that seek to tax Ecuador’s great wealth in different ways. It should be noted that in the country the only person who has legislative authority to define tax matters is the President of the Nation, in this case Lenin Moreno. This is why, up to now, what has been presented by the opposition are initiatives and not a formal draft law. The package is made up of five different initiatives. The first one establishes to collect all the debts that exist with the internal revenue service, which are mostly made up of the country’s great fortunes. The second is the creation of a 0.9% tax for individual assets that exceed one million dollars. The third establishes a 10% tax on the profits that the banks had in the year 2019. According to Pabel Muñoz, of the Citizen Revolution movement, aligned with former President Rafael Correa, «the State lost but the bank won.»

In addition, it proposes to create a 25% rate for the 15 companies that most benefited from a tax remission, that is, they received interest waivers, fines and surcharges last year. Finally, the political force proposes a contribution for the 200 largest economic groups in the country.

«It is a moment where the tax part has to fall only on the richest people in the country,» said Muñoz, who added, «Although the government did not say anything, there are chances that the project will advance in the National Assembly.»

Paraguay

In Paraguay, the “Frente Guasú”, the force led by former President Fernando Lugo, also proposed a tax on large fortunes in order to generate income in the face of the pandemic. The bench in the Chamber of Senators proposed a progressive tax of 1% on assets that exceed 10 million dollars[16].According to studies carried out by the force itself, this would affect approximately 90 families and would allow them to receive an income of close to one billion dollars per year.

In addition, the “Frente Guasú” proposes to establish a tax on High Public Wages, for those who earn more than the President of the Nation, in this case Mario Abdo Benítez, of 20% for three months. Likewise, it is proposed to increase the Selective Consumption Tax on tobacco, alcoholic and sugary beverages and a 5% «green tax» on companies linked to agribusiness.[17]

United States

During the campaign for the presidential elections, in 2019, the Democrat Bernie Sanders held on his platform the need to tax a tax on «Extreme Wealth». The proposal contained the following characteristics:

- Annual tax on extreme wealth of the top 0.1% of US households.

- Applicable on a net worth of more than $ 32 million and anyone with a net worth of less than $ 32 million would not see their taxes go up under this plan.

- Estimated collection is US $ 4.35 billion (bn) over the next decade, and billionaires’ wealth will be cut in half in 15 years.

In addition, as part of her presidential campaign in 2019, Democrat Elizabeth Warren proposed the introduction of a tax on large fortunes of more than US$ 50 million togenerate almost $4 billion in order to «rebuild the United States’ middle class»[18]. Warren takes up inequality data that is overwhelming: «the 400 richest Americans now have more accumulated wealth than all African-American families and a quarter of Latino families combined.» He also cites a report by economists Saez and Zucman (the same ones who made the proposal for the wealth tax in the European Union) where they point out that in the U.S. «0.1% of the richest families owe 3.2% of their wealth in federal, state, and local taxes this year, while 99% of the rest of the population owes 7.2%.

There are no known statements or projects that have reflated this idea in this context of a pandemic, and the truth is that this is the sector of the Democratic Party that was defeated by Joe Biden in the primaries and the objective is to win the election to Donald Trump. Therefore, the reinstatement of the proposal would be conditioned by the electoral framework. It is a developing debate.

From the academic field, the financial expert John R. Talbott proposed in a recent article [19] that in this context of confinement and crisis all the adults of the world should receive 2,000 dollars to be able to buy the necessary food and to be able to pay for their basic services. His plan, he argues, would cost $ 9 trillion and would be financed through a 3% tax on the 10% of the richest population on the planet.

Argentina: exercise of potential collection with a local tax

Faced with the increase in fiscal spending derived from attention to the coronavirus, which initially was equivalent to 1% of GDP in a fiscal package and 1.3% in a credit package (adding 2.3%) and with the latest announcements regarding financing of a portion of the salary of the private sector by the State (almost 3% came), a series of proposals have been made aimed at financing such investment by different members of the government’s political space, deputies of the union bloc, leaders of the Frente Todxs and CTA. The ideas revolve around tax justice with the implementation of a tax, which could be for one time only, to large fortunes.

From CEPA we make an own estimate below, with the following assumptions:

- Tax on 1.5% of the largest assets in Argentina, discriminating between declared assets in the country and abroad.

- Tax on 10% of the net profitability of the 120 best performing companies in their last declared fiscal period.

In relation to the first universe, if the accumulated wealth of the 50 people with the highest wealth in the country is considered, the value reaches about US $ 57,340 million, which is equivalent to $ 3,669,760 million argentine pesos ($ 3.6 billion). The richest family is that of Paolo Rocca, followed by Alejandro Pedro Bulgheroni and family, Gregorio Pérez Companc and family, Alberto Roemmers, Jorge Pérez, Marcos Galperín, Hugo Sigman and Silvia Gold, among others, according to the survey by Forbes Magazine. If a 1.5% tax were charged to these fortunes, the collection would amount to $ 55,046 million. For example, this extraordinary collection would serve, for example, to fund 70% of the cost of the Emergency Family Income (IFE) of $ 10,000 for the self-employed, which amounts to $ 78,000 million pesos ($78 bn) – only in April. In effect, this specific destination would introduce a redistributive component not only in the tax order but also in its spending.

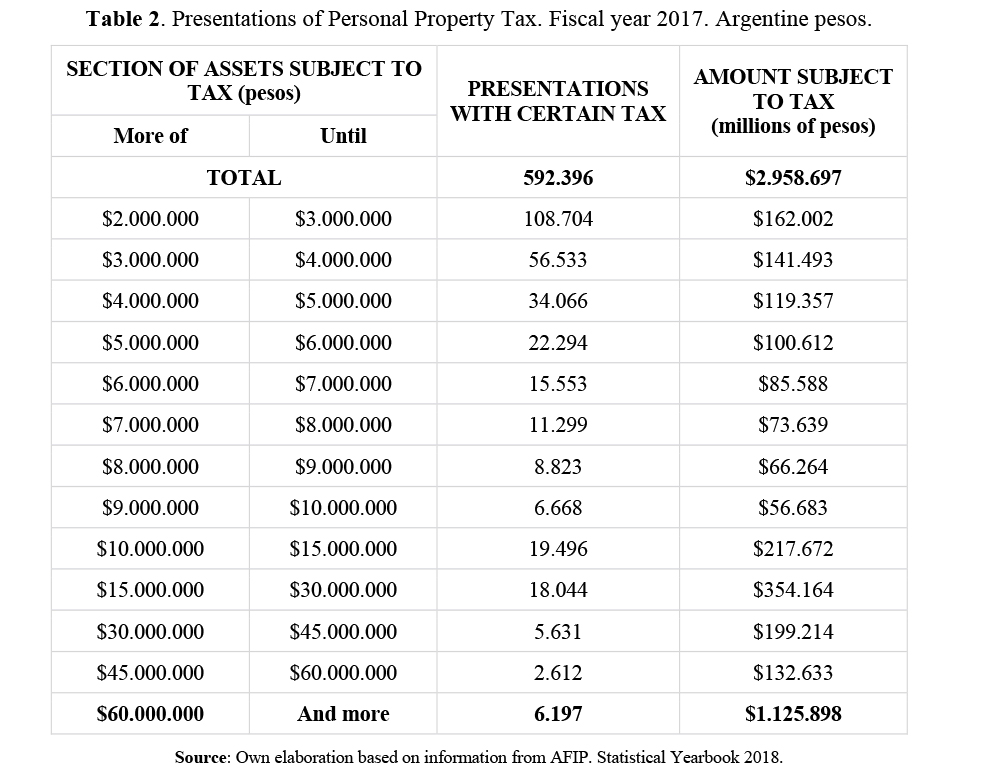

The data of the main assets of Argentina, however, are market estimates made by a private source. To gain precision, it is essential to start from the structure of the Personal Property Tax, since the tax valuation of the property according to the criteria in force in the tax regulations is not always the market value of the same. Based on the latest available data from the Federal Administration of Public Income (AFIP) as of 2017, the largest tranche of declared assets are personal assets subject to tax exceeding $ 60 million in 2017, equivalent to more than $ 3 million in 2017, for which they were taxed only 6,197 people. In the same way, it is noted that only 32,484 people (the last four tranches together) declared assets subject to the personal property tax exceeding $ 15 million in 2017.

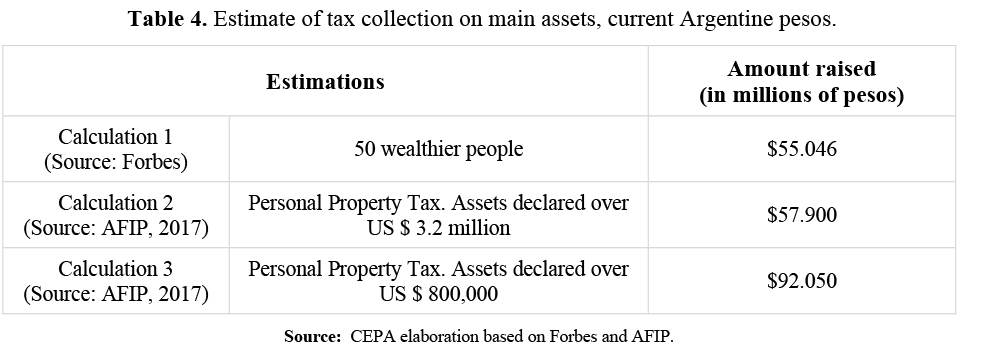

Below is a table with the number of people subject to the tax with the largest tranches of personal property.

If an additional tax of 1.5% were applied, on a one-time basis, to those assets, it could be feasible to obtain fiscal resources equivalent to approximately US $ 893.5 million, approximately $ 57.9 billion argentine pesos. These values are simply a theoretical approximation because the valuation of the assets as of December 2019 is unknown, since the latest disaggregated information available corresponds to December 2017.

If the limit were lower, and the last four tranches of assets were considered for the tax, that is, said special tax would be applied to the 32,484 people with personal assets exceeding $ 15 million argentine pesos in 2017 (equivalent to US $ 793, 6 million), the total additional collection could amount to US $ 1,438 million, about $ 92,050 million (Table 3). Again, this is only an approximation of the order of magnitude that could be collected with an extraordinary tax that taxes a small portion of society; in this case, around 0.07% of the argentine population.

The following table shows the different estimates presented above that approximate the additional collection that could be obtained with different extraordinary tax alternatives on large fortunes. With calculation 1, taking the Forbes source with the 50 largest estates, the extraordinary tax could raise $ 55,046 million. With the second calculation, which takes AFIP data from the personal property base, if the tax on assets exceeding US $ 3.2 million is cut, $ 57.9 billion would be raised. Third, the calculation considers the 2017 AFIP base, although it includes a lower tax floor of US $ 800,000 and thus more than $ 92 billion would be raised.

In the second universe, which refers to the tax on the net profitability of the companies with the best performance in the last fiscal year (2019), an approximation is made taking the profitability of the 62 companies with the highest turnover –with profitability revealed by Mercado Magazine. The total of this universe of 62 companies amounts to US $ 11,910 million, which is equivalent in Argentine pesos to $ 574,530 million. Among the most important are Telecom, Toyota, Pan American Energy, Volkwagen, Vicentin, Cargill. Some of these belong to the State (YPF, Banco Nación, Banco Provincia). It is important to consider that this estimate includes public companies.

It should be noted that the 120 companies with the highest turnover were considered for the selection, and of these, only about 62 presented profitability information. The exercise, therefore, includes a collection estimate considering (A) only the profitability of those 62 companies. –As a minimum floor- and (B) extrapolating the performance of those 62 to 120 in the initial universe. For the 2019 profitability estimate, it was deflated by the 2018 average dollar and it was estimated at the 2019 average dollar. Broadly speaking, a collection of 10% on the income of these 62 companies would yield income to the Argentine treasury of at least $ 57,453 million. If the available profitability information is extrapolated to 100% of the 120 firms considered, the collection amount would total $ 111,199 million ($111 bn argentine pesos).

Conclusions

This report was born from the search for experiences similar to the Argentine debate in recent weeks and found neighboring countries and also witness cases from Europe where the discussion arises. The proposal for taxes on great wealth is not exclusive to Argentina: in different countries of Europe and Latin America there are proposals that advance in greater tax justice, aiming to collect more from those who own the most. There are 5 cases in European countries where the tax on high wealth is part of the public debate in the framework of the COVID-19 pandemic, and there are 7 other cases in countries in South America where proposals in the same sense are registered.

The cases where officials have raised the tribute to large estates correspond to Spain – the Podemos sector that is part of the government alliance – and to Russia, where the idea was mentioned by Putin himself, although aimed at taxing interest that Russian companies make on their owners’ foreign bank accounts and interest on Russian bank deposits and bonds exceeding 1 million rubles (US $13 thousand). Both would be assimilable to the Argentine case, where President Fernández and also his Minister of Finance, Guzmán, spoke in favor of the initiative, which in turn was originally proposed by the Block Leader of the ruling party’s office, Máximo Kirchner. In the rest of the cases in Europe where the existence of debate was detected, it is the political opposition to the officialism that drives the proposals: in the United Kingdom it is about sectors of the Labor Party, in Switzerland it is a leftist party (PST -POP) and in Italy it is a part of the Democratic Party that seems not to have reached consensus on the whole of the ruling alliance. On the other hand, in France, Denmark, Poland and Austria it was determined the exclusion of companies located in tax havens from the state benefits granted by the pandemic.

In America, the debate is emerging with strong initiative.It is also the oppositions that are leading the proposals. In Brazil there are 4 proposals presented in the Senate, and particularly in dialogue with leaders of the PT (Lula’s party) for this report, they show that it is an initiative that has the support of other parties such as PSDB and the left, and also of the CUT union center. In Peru there are two parties, New Peru and Frepap, with an institutional presence in Congress that prepared projects. In Bolivia, the MAS sector led by candidate Arce has a proposal in preparation. In Chile, from the institutional role of Camila Vallejo as a deputy, a proposal was prepared by the Communist Party and it is evaluated to present it to the congress. In Ecuador, he is an assemblyman from the sector aligned with Correa, from the Citizen Movement, who is pushing the initiative – Pabel Muñoz-. In Paraguay, the proposal comes from the Guasú Front, which is led by the ousted former President Fernando Lugo.

It is highlighted, as an interesting case, that in the United States during the presidential pre-campaign in 2019, Bernie Sanders proposed an Extreme Wealth Tax. His defeat in the primaries limits the possibilities of this idea. However, Sanders initiative – and also Senator Warren’s initiative- could resurface considering the complex moment of the pandemic.

Solidarity as a political concept is another axis of analysis. A vast majority of the proposals analyzed include the word solidarity in the name of the promoted taxes. The report reports experiences that have suggested solidarity schemes among those with the highest contributory capacity with respect to more neglected sectors. Although tax schemes are supposed to have the same purpose, it is possible to identify paradigmatic cases prior to the pandemic that illustrate a debate that is often silenced.

In Germany the history of the solidarity tax (Soli) had as its main objective the reconstruction of the unified Germany, interpreting this as favoring the most neglected sectors (East Germany) over the most developed (West Germany). This additional collection allowed to reactivate the economy, instead of appeasing investment as is usually argued by some liberal sectors as a critical argument for taxation.The tax consists of a surcharge to the Income Tax and implies an additional 5.5% on the current rate of said tax, but only for those older income. The tax, which has been held for 30 years, has hitherto had a relatively low limit and the Germany’s recent decision was not to eliminate it but to keep it only for a limited segment, the one with the highest income. In other words, it will remain with similar characteristics for the highest income: around 3.5% of taxpayers will continue to pay the total amount.[20][21]

On the other hand, the growing fiscal needs associated with these measures of income support for families and subsidies for companies reintroduce the debate on the role of the tax system to mitigate inequality. The effects of the COVID-19 pandemic are regressive: they affect in a sensitive way those who have the least, not only in terms of health (worse access to health and unhealthy situation in their daily lives) but also in relation to the economic issue: establishing compulsory isolation and the paralysis of important sectors of economic activity involve affecting the limited incomes of unemployed or informal workers, who do not have access to paid leave, and lack union protection.

This implies a deepening of inequality unless the task of the State reverses or at least compensates the situation. This task has two pillars: how to collect and spending execution decisions.[22]

Indeed, the tax system can play a fundamental role in this emergency situation as a tool to reduce social inequality and poverty (Piketty, 2014).[23]One of the central criteria for subjecting taxpayers to taxes should be taxable capacity (Jarach, 1996)[24] that is to say, the aptitude of the taxpayers according to their wealth and income. This refers to the fact that the tax system must be structured in such a way that those with greater economic capacity have a higher participation in the State’s tax collection. In this sense, a fair tax system is one inspired by the principle of progressivity (Gaggero, 2008)[25]which implies a differentiated treatment between different levels of contributory capacities. However, in fact, those who have greater taxpaying capacity have more resources to avoid paying taxes, while, at present, most of the collection is nourished by regressive taxes, which are levied with the same aliquot taxpayers of high and low economic capacity.

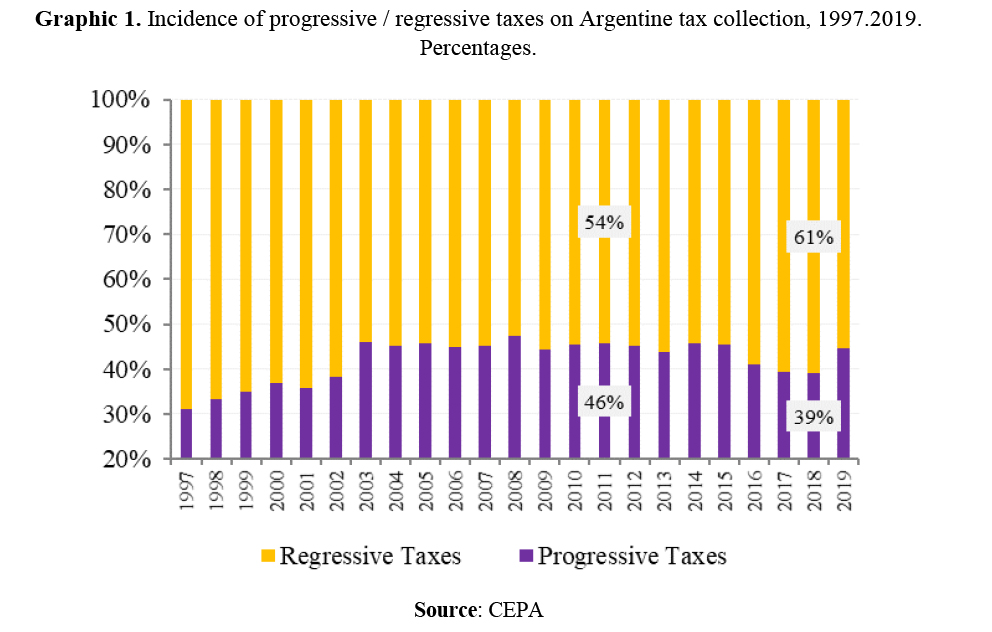

The following table shows the regressive / progressive tax ratio in Argentina between 1997 and 2019. Regressive taxes include VAT, co-owned internal taxes, fuel tax, and credits and debits. Progressive taxes include income tax, personal assets, minimum presumed income and –in a heterodox tax model- export duties are accounted for. In 1997 only 30% of the collection was based on progressive taxes, and the rest -70% – was regressively supported. That equation changed from 2002 where export duties played a strong role. It is observed that during the Macri government (2015-2019) the relationship changes again, falling from 45% to 39% the incidence of progressive taxes (or direct taxes) on collection, there not only due to lower withholdings but also personal property, and loss of collection due to profits in by virtue of the lower salary update regarding inflation.

In the Kirchner period, both by modifying the incidence of progressive taxes and by directing this higher state revenue in a redistributive manner, there was a noticeable reduction in inequality: the Gini index fell from 0.44 to 0.37 between 2003 and 2015, while after 2015, when both effects occurred at time (the drop in progressive taxes and an adjustment in spending), the Gini index went from 0.37 to 0.385 between 2015 and 2018 and fell to 0.38 in 2019.

On the other hand, if we take the international comparison made by the OECD (Organization for Economic Cooperation and Development) to 2017, Argentina is one of the countries with the lowest tax to those with the highest incomes. The OECD estimates how much income taxes weigh on people and on income on companies, on GDP. Progressive taxes and taxes on flows are paid more by those who have more income (capital taxes are excluded, however). In Argentina as of 2017 these taxes weigh 5.3%, while in countries such as Brazil or Chile they weigh 7%. In France 10.9%, Israel 11.6%, Germany 12.2%, United States 12.4%, Italy 13.4%, Canada 15.4%, Australia 15.9%.

Estimation exercise of the Argentine proposal.

In the second part of the report, we carried out an exercise to evaluate the potential collection that a tax on large estates in Argentina would yield, considering different databases – Forbes and AFIP. The final project proposed by the Government -by legislators of Frente Todxs- is not yet known in detail, but the debate could take place in Congress if it is finally a decision promoted by the Goverment house- and there seemed to be political winks regarding that impulse in recent years. days-.

In this work, different estimates have been made about the contribution that Argentina’s great fortunes can make, as well as a handful of large economic groups in our country. Both tools, together, could add between 112,000 and 203,000 million pesos in an extraordinary way to the collection of 2020. Considering «Calculation 2» for large estates (which is taxed from 3.2 million dollars with 1.5% aliquot) ) and considering the estimation (B) of applying a 10% aliquot on the projected profitability of 120 companies with the highest turnover in the country, the additional collection of an extraordinary tax would amount to $ 169 billion.

The application of the tax would take from 45% to 47% the incidence of progressive taxes on total collection – in 2020, in an extraordinary way.In turn, the additional impact on total tax resources to 2020 (updating the 2019 collection according to average annual inflation for 2020 taking Central Bank statistics) would amount to 2.3%. However, it is to be expected that the fall in the annual collection as a result of the recession will be significantly greater than this figure.

[1]The document was prepared by researchers from the Argentine Political Economy Center (CEPA), in the city of Buenos Aires, and published in the local media on April 24th with great repercussion. To see our reports: https://centrocepa.com.ar/. To contact us, write to this e-mail: juliastrada@gmail.com.

[2]https://www.20minutos.es/noticia/4208923/0/podemos-quiere-impuesto-solidaridad-ricos-hacienda-descarta-corto-plazo/

[5]https://mundo.sputniknews.com/rusia/202003261090917774-cambios-en-la-politica-de-dividendos-entraran-en-vigor-en-rusia-a-partir-de-2021/

[6]Germany The SPD proposes to reintroduce the wealth tax for fortunes of more than 2 million euros ”, link:“https://www.rtve.es/noticias/20191208/spd-propone-reintroducir-impuesto-patrimonio-para-fortunas-superiores-2-millones-euros/1993355.shtml

[7]https://www.accountancydaily.co/denmark-and-poland-ban-covid-19-grants-multinationals-based-tax-havens

[8]https://www.businessinsider.com/coronavirus-companies-tax-havens-banned-denmark-poland-bailout-2020-4y consultar sitio de Polonia: https://www.pb.pl/rzad-i-nbp-oglosza-plan-pomocy-firmom-relacja-987800

[9]https://www.nuevospapeles.com/nota/austria-excluye-de-ayudas-por-coronavirus-empresas-en-paraisos-fiscales

[10]https://www.clarin.com/entremujeres/coronavirus-europa-proponen-impuesto-ricos-financiar-crisis_0_1RQXXBBI4.html

[11]https://ptnacamara.org.br/portal/2020/04/14/deputado-paulo-guedes-apresenta-emenda-constitucional-para-taxacao-imediata-de-grandes-fortunas/

[12]https://www12.senado.leg.br/noticias/materias/2020/03/27/senado-debate-quatro-propostas-de-imposto-sobre-grandes-fortunas, andhttps://jornaldebrasilia.com.br/politica-e-poder/4-projetos-para-taxar-grandes-fortunas-tramitam-no-senado/

[13]https://larepublica.pe/politica/2020/04/17/coronavirus-veronika-mendoza-plantea-cobrar-impuesto-de-1-a-empresas-multimillonarias/

[14]https://redaccion.lamula.pe/2020/03/25/frepap-propone-que-millonarios-paguen-impuesto-solidario-proyecto-de-ley-congreso-economica-crisis/jorgepaucar/

[15]https://agendarweb.com.ar/2020/01/28/elecciones-en-peru-partidos-politicos-debilitados-y-fuerza-evangelica/

[16]http://www.senado.gov.py/index.php/noticias/noticias-generales/5435-frente-guasu-plantea-austeridad-y-equidad-para-financiamiento-del-covid-19-2020-04-01-20-44-47

[20]On the other hand, a few years ago two proposals also emerged aimed at solidarity between those who have the most and those who have the least. In the United States, since 2010 there has been Patriotic Millionaires, an association that promotes tax increases for the wealthy to reduce inequality, with a very severe criticism: they consider that the increasing concentration affects democracy itself. In January 2020 and as a result of the Davos 2020 meeting, a letter from that organization read “Taxes are the best and the only adequate way to guarantee adequate investment in the things that our societies need. People who reject this truth represent a double threat to both the climate and democracy itself. Watch:https://www.cnbc.com/2020/01/22/davos-2020-patriotic-millionaires-letter-calls-for-higher-taxes-on-global-elite.html

In France, in 2011, several French billionaires published a request that stated: “We, presidents and directors of companies, men and women of business, finances, professionals or the wealthy, ask for the establishment of a special contribution that will affect French taxpayers more favored ”. He also added that: “We are aware that we have fully benefited from a French model and a European environment with which we are committed and that we want to help preserve”. https://www.elplural.com/economia/los-ricos-y-los-empresarios-franceses-piden-pagar-mas-impuestos_68977102

[22]The CEPA report “Public spending in times of social and compulsory isolation: analysis of budget execution as a reflection of government priorities”, from April 2020, shows the government’s decision, on the spending side, to counteract the regressive effect natural coronavirus: in a few days since the landing of the pandemic in Argentina, spending on food reinforcements with an axis in the territory doubled, resources related to income policy were injected into the most vulnerable sectors (IFE, bonds, etc.), health expenditures were increased and resources that were turned to the provinces and municipalities were doubled. Consult document:https://centrocepa.com.ar/informes/247-el-gasto-publico-en-tiempos-de-aislamiento-social-y-obligatorio-analisis-de-la-ejecucion-presupuestaria-como-reflejo-de-las-prioridades-del-gobierno.html